Trading indicators are essential tools in financial markets, assisting traders and investors in deciphering market trends and making informed decisions. These indicators analyze past and current price data to provide insights into market momentum and potential direction. Understanding how to use these indicators can give traders an edge in identifying profitable opportunities.

Moving Averages

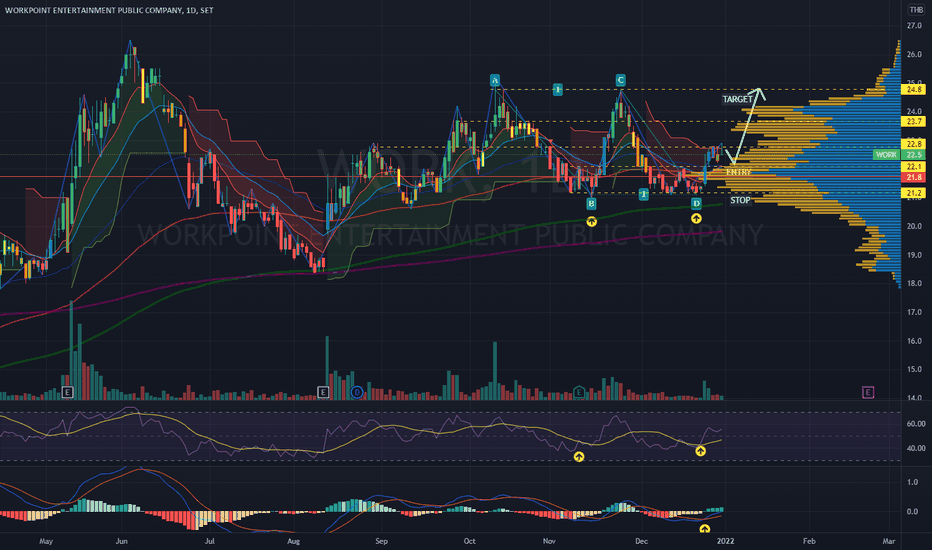

A fundamental tool in trend analysis is the moving average (MA). MAs smooth out price data over a specified period, helping to identify the direction of the trend. There are two primary types: the Simple Moving Average (SMA), which calculates an average of price data, and the Exponential Moving Average (EMA), which gives more weight to recent prices. Both types are used to determine market sentiment and potential price movement.

Moving Average Convergence Divergence (MACD)

The MACD is a more sophisticated tool that evaluates changes in the strength, direction, momentum, and duration of a trend. It consists of two moving averages (the MACD line and the signal line) and the MACD histogram. The crossover of the MACD line over the signal line is significant, often indicating a potential change in trend direction.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It identifies overbought or oversold conditions in the market. The index oscillates between 0 and 100, with readings below 30 suggesting oversold conditions and above 70 indicating overbought conditions. These thresholds can help traders predict potential trend reversals.

Bollinger Bands

Bollinger Bands are used to measure market volatility and identify ‘overextended’ price movements. The bands expand and contract based on market volatility. Prices touching or breaking through these bands can be a signal of potential trend reversals or continuations, providing traders with strategic entry and exit points.

Ichimoku Cloud

The Ichimoku Cloud is a comprehensive indicator providing information about support and resistance levels, trend direction, momentum, and potential trade signals. It consists of five lines, each offering a different insight into market dynamics. This indicator is popular for its ability to give a quick and broad overview of market sentiment.